How to apply for DGFT IEC (Importer Exporter code) Online? - Explained

How to apply for New IEC (Updated) – Step-wise Procedure Explained

To Apply for Importer Exporter Code (IEC) at the DGFT portal you will require:

- Valid Login Credentials to DGFT Portal (After Registering on DGFT Portal)

- User should have an active Firms Permanent Account Number (PAN) and its details like Name as per Pan, Date of Birth, or Incorporation. Note: These details will be validated with the Income Tax Department site

- Scanned documents of:

- Proof of establishment/incorporation/registration:

- Partnership

- Trust

- Registered Society

- HUF

- Proprietorship

- Others

- Proof of Address (any of the documents below):

- Rent agreement, sales/lease deed, telephone land line bill, mobile, post-paid bill, electricity bill, Partnership deed, Memorandum of Understanding (MoU)

- Other acceptable documents (acceptable to Proprietorship) include voter ID, Aadhaar Card and passport copy

- In case the address proof is not in the name of the applicant firm, a no objection certificate (NOC) by the owner of the premises in favour of the firm along with the address proof is to be submitted

- Proof of Firm’s bank account:

- Cancelled Cheque

- Bank Certificate

- An active DSC or Aadhaar of the firm’s member

- Firm’s active bank account for entering its details in the IEC Application and making payment of the application fee online

- Proof of establishment/incorporation/registration:

Note: A user will not be allowed to continue with IEC application if the Firm’s PAN has already been used for registration of IEC with DGFT. (Either PAN Based IEC or Numeric IEC)

Steps for IEC Application:

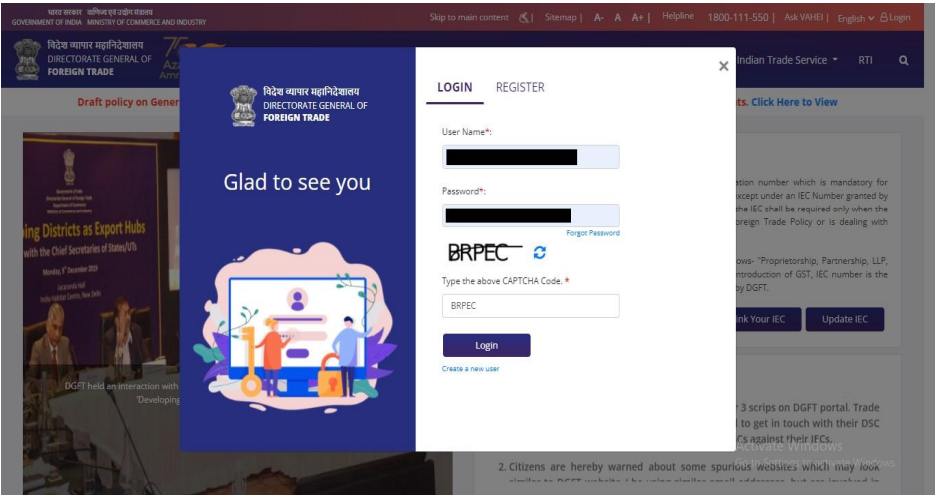

- Visit the DGFT website and login into the portal with valid credentials.

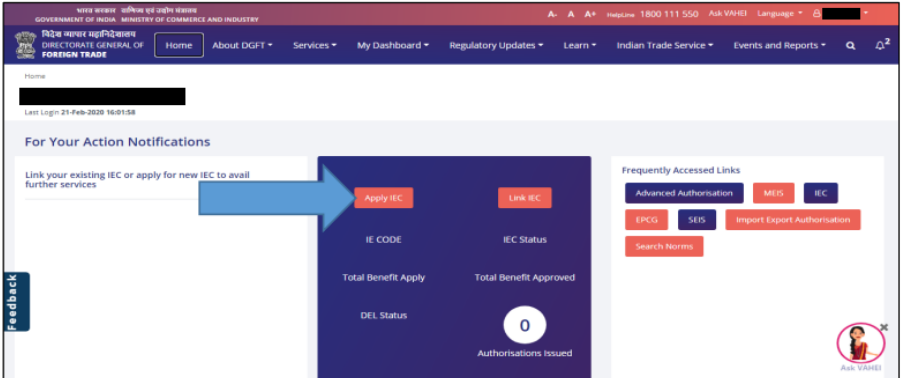

- Post login click on “Apply for IEC” on the Dashboard.

- Click on “Start Fresh Application” button or click on “Proceed with Existing Application” Button in case user already saved a draft application

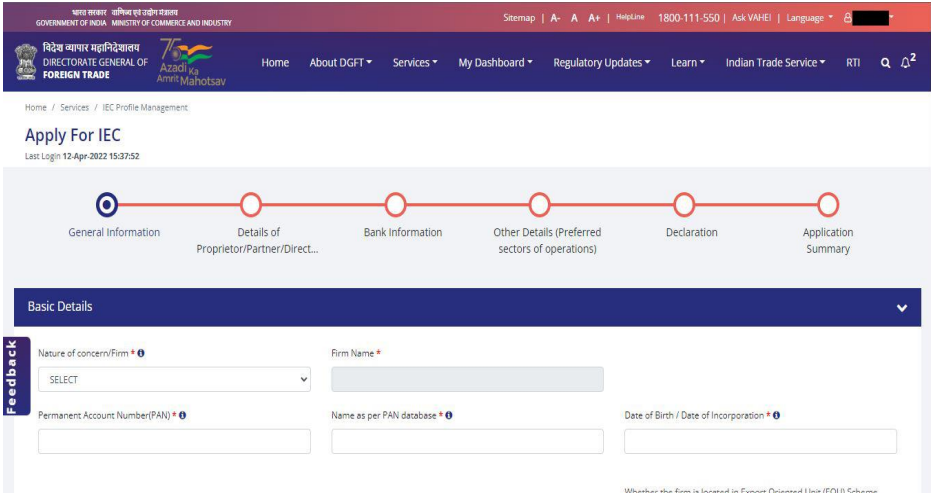

- Enter the details in the General Information Section( All the Mandatory fields have been marked with a Red Asterisk [*].The Draft will only be saved if the Mandatory details in the “Basic Details” Section and “Firm Address Details” Section.)

- Select nature of Concern/Firm.

- Enter Firm Name

- PAN, Name (As per PAN Database) and Date of Birth/ Date of Incorporation

Note: These details are verified in real-time from the CBDT database. Please note that the name (per PAN database) must contain “first, middle and last name” provided when registering for PAN with CBDT/NSDL

- Select Preferred Activities from the given values

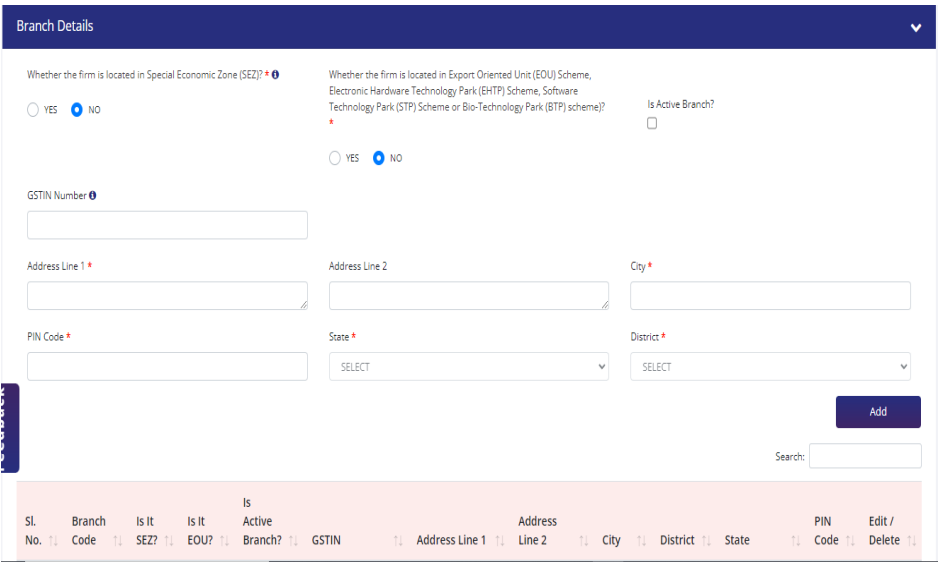

- Fill up the questions – “Whether the firm is located in Special Economic Zone (SEZ)?” & “Whether the firm is located in Export Oriented Unit (EOU) Scheme, Electronic Hardware Technology Park (EHTP) Scheme, Software Technology Park (STP) Scheme or Bio-Technology Park (BTP) scheme)?” – On the basis of which DGFT RA or SEZ mapping of offices will be done

- Enter the company number (CIN). After entering the CIN, the system will check the CIN from the Ministry of Corporate Affairs (MCA) server and retrieve the company details and director details if available

- Enter GST Number of the firm if applicable

- Enter the company mobile phone number (for correspondence with the DGFT). User can update mobile number after receiving OTP validation on provided number

- Enter firm’s email ID (for correspondence with the DGFT). User can update mobile number after validation with OTP received on given number.

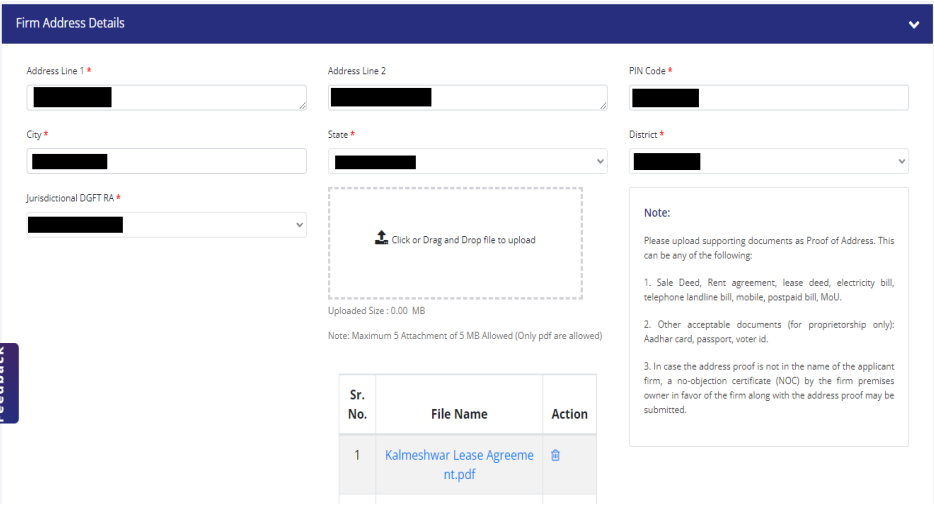

- Enter the business address, city and PIN. Based on the PIN entered by the user, the state, county and jurisdiction of DGFT RA are selected by the system.

- Include proof of business address. This is required for address verification.

The proof of address can be one of the following documents:

- Purchase agreement, rental agreement, lease agreement, utility bill, landline, mobile phone bill, postpaid bill, MoU, Partnership Deed

- Other acceptable documents (for proprietorship only): Aadhaar Card, Passport, Voter ID.

- In the event that the proof of address is not in the applicant firm’s name, a certificate of no objection (NOC) from the owner of the premises in favor of signature must be submitted along with the proof of address as one document PDF.

- Enter branch if any.

- Enter the GSTIN number, address, city and PIN code of the branch(s) associated with the importer exporter code above

- Enter the details in the “Details of Proprietor/Director/Partner/Karta/Trustee” Section

- DIN (Dir. Identification Number) is auto fetched from Ministry of External Affairs based the CIN number provides above in general information section. Note: The user will not be able to delete the director details fetched from MCA

- PAN, Name (As per PAN Database) and Date of Birth/ Date of Incorporation – These details will be verified real-time from the CBDT database. Please note Name (as per PAN Database) should include “First Name, middle name and last name” provided while registering for PAN with CBDT/NSDL

- Enter Name, Father Name, Address, City, Pin Code, State, District and Mobile number of Proprietor/Partner/Director/Karta/Managing Trustee.

- In case the Director is not an Indian National, tick the check box “Is the Director a Foreign national?”

DGFT

Legal

Company Secretarial

DGFT Notifications

Others

Recent Posts

- DGFT amends policy condition under ITC (HS) code for Potatoes

- CPCB extends date to file Annual Returns for EPR Plastic

- DGFT modifies SION E-125 consisting export of SHEA STEARINE

- DGFT amends the Jewellery SION Norms under the HBP, 2023

- DGFT restricts imports of all Electronic and IT Goods

- CPCB changes validity of EPR Certificate from “One Year” to “One Time Registration”

- DGFT amends list of Ministries/Departments under Appendix 2Y of FTP, 2023

- Central Govt. permits export of Non-Basmati White Rice through NCEL

FeATURED ARTICLES

DGFT amends policy condition under ITC (HS) code for Potatoes The Central Government makes amendment in the Policy Condition for…

DGFT modifies SION E-125 consisting export of SHEA STEARINE Standard Input Output Norm (SION) E-125 for the export of Shea…

DGFT amends the Jewellery SION Norms under the HBP, 2023 The Director General of Foreign Trade makes the following amendments:…

DGFT restricts imports of all Electronic and IT Goods Central Government notifies the amendment in Para 2.31 of the Foreign…